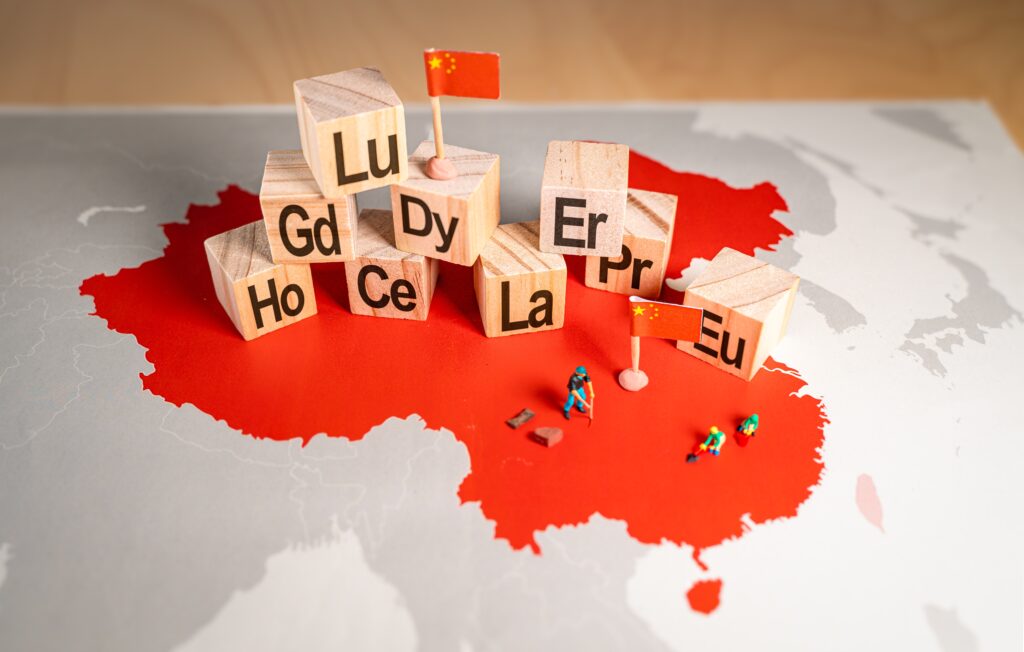

In the midst of its trade war with the United States, China stopped the export of rare earths in April.

This triggered a frantic response in many western capitals, as China holds a near-total monopoly on certain earths.

Scrambling to find alternatives, the few non-Chinese suppliers quickly reached capacity, charging hefty premiums.

Following an agreement with the Trump Government, China gradually reopened the export channels, but having seen the leverage they hold, Beijing has since held back on certain crucial earths it was exporting freely before – with massive implication on the global markets.

How is China choking the manufacturers out?

Take Germany, for instance. The country’s struggling automotive industry is pushing towards electric cars, with giants like Volkswagen aiming for 70 per cent of its vehicles to be electric by 2030. To build batteries for these cars, the Germans need Chinese rare earths – but sourcing them is proving difficult, with affordable materials even more illusive.

Economics paper Handelsblatt quotes German industry sources as saying that the Chinese have been extremely hesitant to give a green light to crucial earth exports recently.

This has dramatic implications: German Economics Minister Katharina Reiche admitted in late June that some companies have had to stop their production entirely as they struggle to obtain enough rare earths from China. Reiche declined to name the companies.

Across the pond, American automotive giant Ford is also struggling to obtain certain earths from China for its EVs. “It’s gotten better since the full rare earth export stop, but it’s still hand-to-mouth,” Lisa Drake, who oversees the industrial planning for electric vehicles at Ford, told the Wall Street Journal. She says Ford has had to “move things around” to avoid having to shut down plants.

Although they were not available for comment on whether their supply chains had been affected, UK automaker Jaguar also requires Chinese rare earths to build its electric cars.

Jaguar employs 11.000 workers in the UK, and is currently transitioning to full-electric by discontinuing its combustion engine models.

Other industries are affected, too. South Korean newspaper Chosun quotes a government official saying that companies there are also currently experiencing massive difficulties because of disruptions in supply from China.

According to the official, this has particularly impacted the electronics and heavy equipment industry, a major economic force in South Korea.

What trade restrictions are in place?

According to Chinese Customs, those wanting to receive rare earth shipments now have to apply for an export license, which can take up to 45 days.

Customs also require proof that the material will not be used for military purposes. China has tried to reassure manufacturers repeatedly that it is trying to make this exporting process as easy as possible, and these difficulties are only aftershocks of the full stop in April – but according to an exclusive investigation by South Korean newspaper The Chosun, there is a system to the delays manufacturers are experiencing.

Chosun reports that the Chinese have put the permits of up to 2,000 rare earth items under review recently, a full revamp of the previously largely limitless exports. This list reportedly includes materials needed for electric vehicles and batteries, precisely the earths European and Korean manufacturers are missing.

Some experts thus call this political maneuvering. “The Chinese realized during the trade war with the US and the full export stop that they can use rare earths to achieve political goals,” Stefan Steinicke of the German Association of Industry told German newspaper Spiegel. “We’re heading for a crisis if they keep doing this,” he adds.

Trying to ease the tensions, on the 14th of July, the Chinese government released data showing that the value of its rare earth exports in June was up 30 per cent from May. But some call a bluff, as the data released only shows a general number, not broken down by product category.

“It’s likely to simply be a shift in the export mix, where China exports more of the cheaper rare earths but still holds back the crucial expensive ones,” the South China Morning Post quotes Xu Tianchen, senior China economist at the Economist Intelligence Unit.

Why does China hold such a monopoly?

In 1992, the then-president of China Deng Xiaoping, was quoted as saying that “the Middle East has oil, China has rare earths.”

96 per cent of the world supply of some crucial rare earths are sourced from China, with the country having built a monopoly for decades.

The earths are not actually that rare at all, but mining them often comes at the price of massive environmental impact.

This can be observed in Baotou, China’s “rare earth capital”. Mining has created a toxic lake here, which poisons the groundwater in summer and creates toxic winds in winter, with a jarring impact on the health of local residents. All of these are effects the West has conveniently outsourced to China for decades.

Meanwhile, the Chinese have pumped billions into the industry, often being accused of artificially dropping prices to make competitive mining in other countries unprofitable.

With mining deemed a critical industry, the PRC has created so-called “bad banks” where mining companies can obtain seemingly infinite funds, which has further deepened the monopoly.

How can Western manufacturers become less dependent?

Well, they could outsource the mining to other places. Countries where crucial rare earths are found in relatively easily mineable condition would for instance be Chile, Mexico or Bolivia- but amidst the shortage in the West, they can play the long game.

Mexico and Bolivia have long nationalised their crucial reserves, and Chile is planning to do so too. Any deals here go directly through the state, and earth-rich countries can make their demands to Western companies, again creating a dependence.

There have been efforts to join forces here, with the G7 starting the Minerals Security Partnership with India, South Korea and Estonia, where all involved countries pool funding for strategic rare earth projects, but the supported projects have been few.

Another viable option seems to be domestically mining and processing the crucial earths. The US has some mineable reserves, and is currently trying to expand from its only functioning mine to more across the country. In Australia, the Mount Weld mine has significant capacities, and the mine’s parent company Lynas is expanding globally.

As far as the EU is concerned, meanwhile, the process has been slower. The responsible commission passed the Critical Raw Minerals Act in 2024, which aims to reduce dependence on China, and the Europeans want to mine 10% of their annual needs within the EU by 2030. Mineable rare earths can for instance be found in the Czech Republic- but as of now, all projects are still in the planning stages.

Either way, industry experts say decoupling from China will take a while, even with ambitious projects. “We have to recognize that we’re playing a 30-year catch-up game here,” Lynas CEO Amanda Lacaze said last year.

So is everyone just at China’s mercy for the next decades? Well, not quite.

Myanmar: The thorn in China’s side

The PRC ironically does not mine much of the earths it exports domestically, either. Instead, up to half of Chinese rare earths are mined in the Kachin province in Myanmar by the country’s Military Junta, and then just shipped to China for processing. This provided a relatively secure supply of the rare earths to China for decades.

But these days, Kachin province is one of the hotbeds of fighting in Myanmar’s ongoing civil war, as the Kachin Independence Army (KIA) fights the Junta for control in the area- and the KIA is gaining more and more ground.

The Chinese have gone to great lengths to pressure the rebels to stop their advances against the Junta, trying to safeguard the rare earths supply and retain control of key mines. For instance, China has arrested some KIA leaders to force the handover of cities strategic for the rare earth trade.

As a seemingly last resort, the Chinese have also threatened to stop buying earths from mines now controlled by the rebels. The KIA primarily funds itself through the export of resources, so a stop to the exports would take away a large portion of the militia’s funding. Already, Chinese rare earth imports from Myanmar have halved compared to last year.

But it is a dangerous gamble for the Chinese. Reuters quote a rebel leader as saying that “China, which needs rare earths, can only tolerate this lack of supply for a limited time.“ A big part of the KIA’s ideology is regional autonomy, and the end of what its leaders perceive as an exploitative extraction of the area’s resources.

With the KIA advancing further despite Chinese pressure not to, Beijing will have to strike some kind of deal with the KIA, or stop the imports entirely- which would no doubt trickle down globally, and open up a possibility for other countries to sweep in.

So, China has the world in a rare earth chokehold- but it may have difficulties obtaining its own rare earths soon.

Featured image via Ivan Marc / Shutterstock.