The global health landscape is undergoing one of the most significant transformations of the 21st century, and the spark is obesity treatment innovation. After years of slow progress and public health frustration, we find ourselves in 2025 at a decisive juncture: one where the conversation is no longer about if anti-obesity medicines (AOMs) can reshape cardiometabolic risk, and even risk factors for conditions beyond cardiometabolic, but how fast, how equitably, and how sustainably this change can occur.

At IQVIA, we have been closely analysing the evolution of this space. In this article I reflect on where treatment is today, where it is headed, and why 2025 represents not a pause, but a profound acceleration.

From Transition to Trajectory: Where the Market Stands in 2025

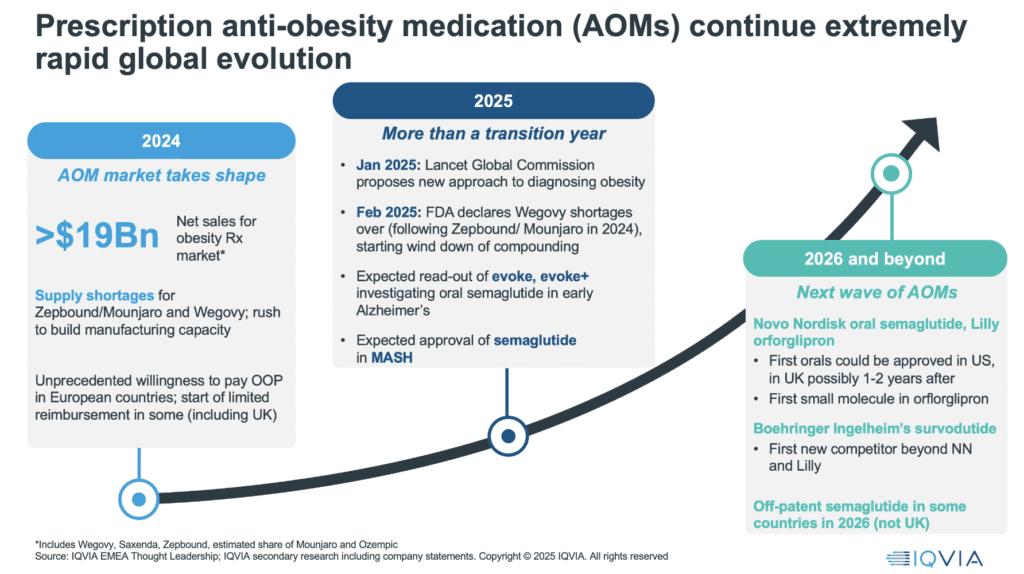

2024 was a landmark year for the anti-obesity medicines. We saw hugely accelerating use across more countries, resulting in around $20bn global net sales from key anti-obesitymedications (AOMs), including Wegovy®, Zepbound®, and Saxenda®, and we witnessed something few predicted: unprecedented out-of-pocket demand, particularly in Europe, and the beginning of limited reimbursement in some ex-US countries. But 2025, while devoid of major new launches, is far from static, this is a year of consequence.

We have seen the end of key supply shortages, a major milestone for both semaglutide and tirzepatide. The publication of the Lancet Commission on Obesity has laid the groundwork for policy reform, affirming obesity as a chronic, standalone disease. We anticipate breakthrough readouts from trials investigating the use of AOMs in Alzheimer’s disease and metabolic-associated steatohepatitis (MASH) – potentially continuing expansion of the value proposition for these drugs beyond weight loss.

The Weight of the Problem

Despite medical progress, the scale of the challenge is immense. By 2050, the global population living with overweight and obesity could reach 3.8 billion adults, with the sharpest increases in Asia and Africa. Yet these new medicines, while powerful, are not magic bullets. They must operate within a landscape of rising childhood obesity, fragile health systems, and an expanding burden of comorbidities – including cardiovascular disease, diabetes, and obesity-related cancers.

The human and economic cost is already severe. In 2019, more than 5 million deaths were directly attributable to excess body weight, and obesity contributed to 160.3 million disability-adjusted life years (DALYs). Financially, the burden is comparable to major global crises: the World Obesity Federation estimates that overweight and obesity could cost the global economy over $4 trillion annually by 2035, around 3 per cent of global GDP – a similar order of magnitude to the impact of the COVID-19 pandemic.

Real-world data from IQVIA, for example from Germany, further underline the stakes, showing a clear correlation between higher BMI and serious cardiovascular outcomes such as heart failure and atrial fibrillation. Simply put, preventing and managing obesity arefundamental to preventing chronic disease.

A Shift in Clinical and Commercial Expectations

2025 also marks a pivot in how we think about performance and value in anti-obesity medications (AOMs). Investors and analysts have, to date, focused heavily on the speed and magnitude of weight loss – driving a “race to the top” in clinical development. Some pipeline agents now show weight loss approaching (or even exceeding) bariatric surgery outcomes.

But is weight loss the only – or even the most important – metric?

Clinicians are increasingly calling for a broader definition of success: one that includes muscle preservation, improved quality of life, cardiovascular outcomes, and sustained weight loss and safety. Tolerability, especially gastrointestinal side effects, matters deeply to patients, as does the flexibility of dosing format – injectables versus orals, daily versus monthly. These will shape uptake, adherence, and persistence.

The Rise of Orals and the Battle for Maintenance

We expect 2026 to usher in a new era of oral AOMs, led by Novo Nordisk’s oral semaglutide and Eli Lilly’s orforglipron. This shift will not just be about convenience – it may reshape pricing models, manufacturing economics, and access in low- and middle-income countries. Oral small molecules could, for example, potentially, offer lower-cost, scalable alternatives, and perhaps represent the logical choice for long-term maintenance therapy, where required.

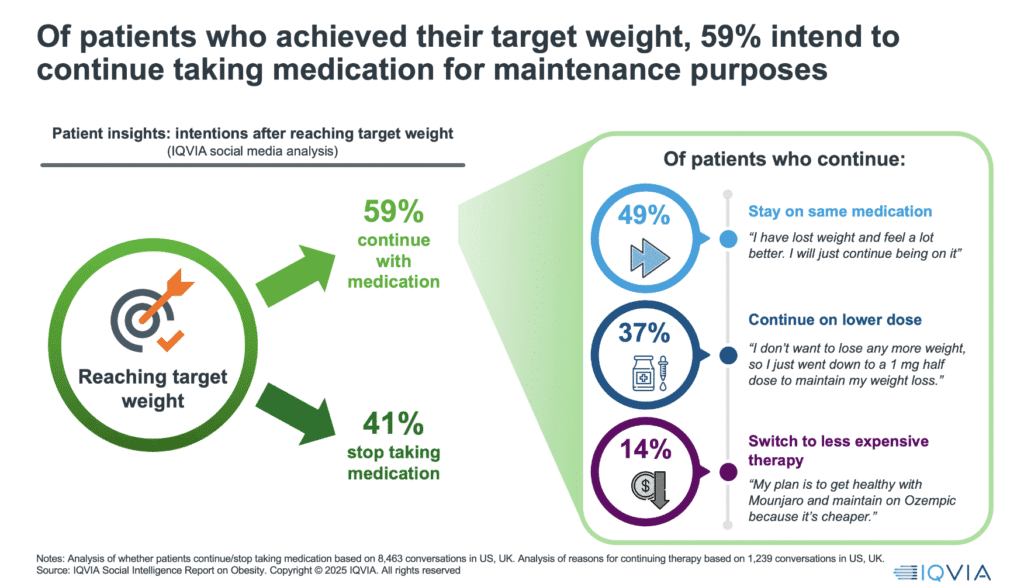

Because here is the quiet truth of 2025: the “induction” phase – patients initiating therapy to lose weight – is in full swing, with markets like the UK seeing a tenfold increase in private prescriptions in a single year. But the maintenance phase is coming, and it may prove even more important clinically, and also commercially. Early social media insights from IQVIAsuggest over 60 per cent of patients want to continue therapy after reaching their weight goal. Many are willing to switch to lower-cost or alternative products to do so.

Reimbursement: Still the Elephant in the Room

Despite the clinical promise, reimbursement lags far behind. IQVIA’s analysis of European and Middle Eastern markets shows that only a few countries – like the UK, Switzerland, and Israel – have even partial public coverage for AOMs. Meanwhile, private prescription markets are booming. Over a million people in the UK are now estimated to be paying privately for obesity medications.

But this creates an equity gap. As the science advances and demand grows, payers face critical questions:

• Who should get access?

• What time horizon is appropriate to assess value?

• Where will savings be realised, and when?

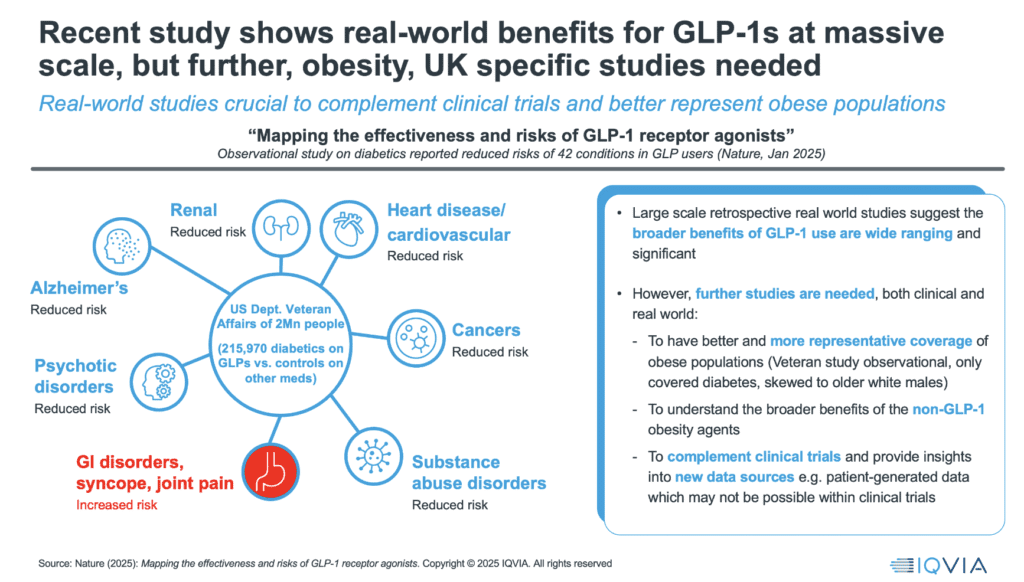

Today, there is little systematic evidence to guide these decisions. This is where real-world evidence must step up. Data from large patient cohorts, such as the more than 200,000 diabetic US veterans tracked on GLP-1s, show significant reductions not just in diabetes and heart disease, but in Alzheimer’s, certain cancers, and even psychiatric conditions.

Clinical Trials Under Scrutiny

If real-world data is the destination, clinical trials are the gateway – and they’re facing increasing scrutiny. Our analysis shows that current obesity trials often fail to reflect the real-world obese population in terms of gender, age, and ethnicity. This undermines generalisability and risks creating evidence gaps for the populations who may need these medicines most. Draft US Food and Drug Administration (FDA) guidance now calls for better body composition tracking and demographic representation, a step in the right direction.

Moreover, adherence challenges in trials – particularly when patients can tell whether they’re on placebo – are becoming more prominent as expectations rise, and the number of agents in clinical trials increases.

What Comes Next: Innovation, Equity and Maturity

The obesity pipeline is large and diverse. Over 170 assets are currently in development, many with mechanisms of action that go well beyond GLP-1. A key area of interest is muscle-preserving weight loss – especially critical for older patients – and the development of agents that are both tolerable and effective over long durations.

But as innovation accelerates, we must not lose sight of access. No country today can be called “mature” in its policy approach to obesity care. Even the UK, a global frontrunner, is still cautiously expanding public access.

The ultimate goal in addressing overweight and obesity must be to “bend the curve” – to prevent the projected rise to 3.8 billion adults living with overweight or obesity by 2050, and in doing so, reduce the associated burden of chronic disease and economic cost, which could exceed $4 trillion annually by 2035.

For the pharmaceutical industry, an additional prize is the significant commercial opportunity created by a new, innovative market in anti-obesity medicines, expected to be worth between $100 billion and $200 billion by 2030. This growth is likely to fuel further investment in obesity research and broader cardiometabolic innovation.

Realising both the public health and commercial potential will require payers, policymakers, and industry leaders to evolve together – ensuring that scientific advances translate into wide, equitable access and lasting health impact.

Final Thought: The Path from Promise to Progress

Obesity is no longer a marginal or lifestyle issue – it is the defining public health and chronic disease challenge of our generation. The scientific breakthroughs of the last two years have radically reframed what is possible. But science alone will not solve obesity. Policy, reimbursement, and system reform are now the critical bottlenecks.

As of 2025, the conversation must shift from can we treat obesity effectively? to how do we scale that treatment fairly, sustainably, and strategically? We are witnessing the birth of a new therapeutic category – one that does not merely reduce weight but redefines cardiometabolic and other risks and reshapes how chronic disease is managed at population level.

To realise the full potential of this moment, policy makers must act decisively in four key areas:

1. Acknowledge Obesity as a Chronic Disease: This is a foundational step. Many national health systems still treat obesity as a lifestyle issue, which undermines access to treatment and stigmatises patients. Following the Lancet Commission’s call to define obesity as a chronic, relapsing disease would reframe policy thinking and enable the development of comprehensive treatment pathways that include pharmacotherapy, behavioural support, and long-term follow-up.

2. Design and Fund Equitable Access Pathways: Out-of-pocket markets are thriving – but they risk entrenching inequity. Public payers must create clear, criteria-based access frameworks that prioritise high-risk individuals and those with comorbidities, while planning for staged, scalable rollout. Reimbursement need not be universal on day one, but it must be principled, transparent, and aligned to health outcomes.

3. Invest in Evidence Generation Beyond Clinical Trials: Real-world data will be essential to tracking long-term effectiveness, safety, adherence, and health system impact. Policymakers should fund and mandate longitudinal observational studies, support cross-border data collaboration, and encourage post-marketing commitments from manufacturers. Without robust data on value and outcomes, reimbursement decisions will falter.

4. Enable Sustainable Competition: The obesity market is still young and a rich pipeline of AOMs is coming. Health systems must avoid “lock-in” to early entrants and build frameworks that encourage new entrants, novel mechanisms, and eventual genericisation. Tendering, value-based pricing, and careful formulary design will all be essential. And manufacturers must be challenged to deliver affordability as well as innovation.

Policymakers have a narrow but critical window of opportunity to shape the future of obesity care. Done right, this could be one of the most impactful public health investments of our time – one that reduces multimorbidity, restores lives, and relieves long-term health system pressure.

But the moment must be seized with intent. The science is ready. Now, the systems must follow.